Hey there, I’m your friendly New Jersey real estate agent, and today I want to share some valuable insights on making the transition from being a renter to a proud homeowner right here in the Garden State. I can teach you how to obtain “homeownership in New Jersey” too. So sit back, relax, and keep on reading. I love talking all about New Jersey Real Estate.

As of my last update in September 2023, over 35% of Americans are renters, shelling out a median of $1,937 each month in rent, according to Rent.com. Interestingly, homeowners in New Jersey pay just $209.00 more on average, with a monthly housing cost of $1,510, according to the US Census Bureau. It’s worth noting that these numbers can vary, but the point is, that owning a home might be more attainable than you think.

The real challenge often lies in the misconceptions that plague potential homebuyers, especially among younger generations. From the belief that you need a hefty 20% down payment to the misconception that mortgage payments are significantly higher than rent, these myths keep many folks stuck in the renter’s cycle.

Today, I’m here to guide you through the various paths that can lead you to homeownership. We’ll help you move from “No, you can’t paint the living room” to the joy of decorating your space, planting your garden, and even having that long-awaited furry friend.

Step One: Mental and Financial Preparation

Before embarking on your journey to homeownership, it’s crucial to be mentally prepared and financially ready. Here are some essential questions to consider:

- Support System: Do you have a solid support system to assist you through this process? Choosing the right real estate agent can make all the difference, especially if you need some “real estate therapy” to navigate the intricacies of home buying.

- Emotional vs. Investor Thinking: Are you prepared to let go of emotions and think like an investor? Sometimes, your dream home may not align with your financial reality, and you may need to make pragmatic decisions to start building equity.

Getting Your Finances in Order

- Budget Assessment: Use a budget worksheet to evaluate your financial health, like the ones available at MortgageCenter.com and the Consumer Financial Protection Bureau.

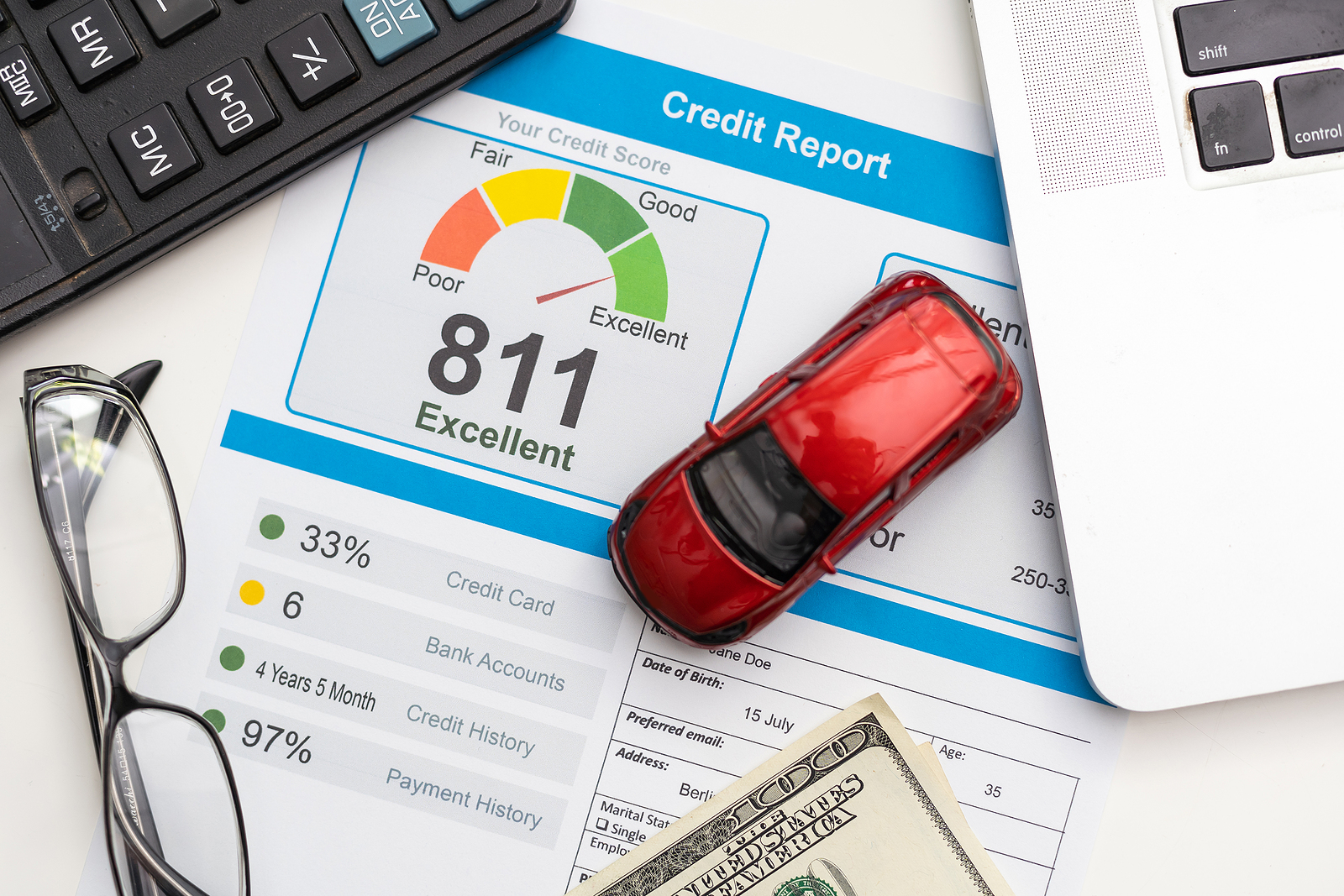

- Check Your Credit: Monitor your credit report and score, ensuring that you pay bills on time and keep credit card balances below 30% of the limit.

Here is a list of which aspects of your credit report lenders will scrutinize the most:

- Have you recently applied for credit?

- Do you pay your bills on time?

- Are your credit limits maxed out? Lenders want to see balances no higher than 30% of the limit.

- Have you declared bankruptcy?

- Are you an authorized user of someone else’s credit card?

Work on getting your credit balances where they should be, paying bills on time, and avoiding opening new credit accounts.

Consult a mortgage broker

Once you have a clear understanding of your budget and credit, it’s time to consult a mortgage broker. They can help you determine how much you can borrow and what your down payment requirements will be. Don’t forget to ask about potential down payment assistance programs at the state, local, and federal levels.

Save up some money for the down payment and closing costs

Certainly, I’ve rewritten the blog in the first person with SEO-rich keywords to target buyers and sellers in New Jersey:

From Renter to Homeowner: My Guide for Young Buyers and Sellers in New Jersey

🚥 STATUS: Draft 📅 EDITED DATE: 9/12/2023

Hey there, I’m your friendly New Jersey real estate agent, and today I want to share some valuable insights on making the transition from being a renter to a proud homeowner right here in the Garden State.

As of my last update in September 2023, over 35% of Americans are renters, shelling out a median of $1,937 each month in rent, according to Rent.com. Interestingly, homeowners in New Jersey pay just $209.00 more on average, with a monthly housing cost of $1,510, according to the US Census Bureau. It’s worth noting that these numbers can vary, but the point is, owning a home might be more attainable than you think.

The real challenge often lies in the misconceptions that plague potential homebuyers, especially among younger generations. From the belief that you need a hefty 20% down payment to the misconception that mortgage payments are significantly higher than rent, these myths keep many folks stuck in the renter’s cycle.

Today, I’m here to guide you through the various paths that can lead you to homeownership. We’ll help you move from “No, you can’t paint the living room” to the joy of decorating your space, planting your garden, and even having that long-awaited furry friend.

Step One: Mental and Financial Preparation

Before embarking on your journey to homeownership, it’s crucial to be mentally prepared and financially ready. Here are some essential questions to consider:

- Support System: Do you have a solid support system to assist you through this process? Choosing the right real estate agent can make all the difference, especially if you need some “real estate therapy” to navigate the intricacies of home buying.

- Emotional vs. Investor Thinking: Are you prepared to let go of emotions and think like an investor? Sometimes, your dream home may not align with your financial reality, and you may need to make pragmatic decisions to start building equity.

Getting Your Finances in Order

Becoming a homeowner requires financial stability and planning. Start by assessing your current financial situation. Consider your income, expenses, and savings. Here are some steps to help:

- Budget Assessment: Use a budget worksheet to evaluate your financial health, like the ones available at MortgageCenter.com and the Consumer Financial Protection Bureau.

- Check Your Credit: Monitor your credit report and score, ensuring that you pay bills on time and keep credit card balances below 30% of the limit.

Consult a Mortgage Broker

Once you have a clear understanding of your budget and credit, it’s time to consult a mortgage broker. They can help you determine how much you can borrow and what your down payment requirements will be. Don’t forget to ask about potential down payment assistance programs at the state, local, and federal levels.

Saving for the Down Payment and Closing Costs

Now, let’s talk about saving for that down payment and covering those closing costs. Here are some strategies:

- Dedicated Savings Account: Create a dedicated homebuying savings account and automate contributions from your paycheck.

- Side Income: Consider taking on a part-time job or a side gig to boost your income.

- Down Payment Assistance: Explore down payment assistance programs recommended by your mortgage broker.

- Cut Expenses: Some are even moving back home temporarily to accelerate savings. With the median rent in New Jersey at $1,937, a year of savings could amount to $23,244!

Transitioning from a tenant to a homeowner is an exciting journey, and with careful planning and preparation, you can make it a reality. Remember, professional advice from a real estate agent and mortgage broker can be invaluable.

If you have questions or need guidance, feel free to reach out. Advice is always free, and I’m here to help.

Please note that I’m not a mortgage professional, and the legal and financial information provided in this blog post is for general informational and educational purposes only. Always seek professional advice for your specific situation.

About Cori Dunphy – Your Trusted New Jersey Real Estate Expert

Hello, I’m Cori Dunphy, your dedicated New Jersey real estate professional with over 21 years of experience in the dynamic world of New Jersey real estate. With my deep-rooted passion for helping clients navigate the ever-evolving market, I’ve become a trusted name in the industry.

My journey in New Jersey real estate started in Monmouth County, where my office proudly resides. However, my expertise knows no boundaries, as I’ve been serving buyers and sellers across the entire state. Whether you’re searching for your dream home along the picturesque Jersey Shore or looking to make a strategic move in the bustling North Jersey market, I’m here to guide you.

As a seasoned real estate agent, I understand the nuances of New Jersey’s diverse neighborhoods, pricing trends, and the intricacies of the buying and selling process. My mission is to empower you with knowledge and insights, making your New Jersey real estate journey a smooth and successful one.

With my extensive experience, I’ve had the privilege of helping countless clients achieve their homeownership dreams, and I’m here to do the same for you. Whether you’re a first-time homebuyer or a savvy investor, I tailor my services to your unique needs, ensuring you make informed decisions in this exciting New Jersey real estate landscape.

So, whether you’re ready to explore stunning properties along the Jersey Shore, invest in the vibrant cities, or sell your cherished New Jersey home, trust Cori Dunphy for your New Jersey real estate needs. Together, we’ll embark on a journey that’s as rewarding as it is transformative.

Contact me today, and let’s take the first step toward achieving your New Jersey real estate goals.